Stairlift Insurance: Guide, Pros, Cons and Costs 2025

- Lift insurance can safeguard you from high repair or replacement costs due to unforeseen damages.

- Basic policies may start at around £40 annually, while comprehensive plans can exceed £500.

- The price of stairlift insurance can vary widely based on factors such as the type of stairlift, its value, and the coverage level you choose.

Stairlift insurance is an essential consideration for those who rely on these mobility aids to navigate their homes safely. Understanding the various aspects of lift insurance can help you make an informed decision that ensures peace of mind and financial protection.

In this guide, we’ll explore the pros and cons of lift insurance, outline what factors influence the costs, and provide tips on selecting the best policy for your needs.

Looking for stairlift quotes? Instead of spending hours researching and contacting multiple companies yourself, try our simpler method. Just fill out our quick 30-second form, and you’ll get up to 4 free quotes from local stairlift providers and installation experts. This service is entirely free and comes with no obligations. Click the button below to begin!

Contents

Is stairlift insurance necessary?

How much does stairlift insurance cost?

What does a stairlift insurance cover?

What are the alternatives to stairlift insurance?

Which stairlift companies offer insurance?

Is stairlift insurance worth it?

Is stairlift insurance necessary?

Stairlift insurance is not a mandatory requirement in the UK, but it can provide significant peace of mind and financial protection. Given the high costs associated with repairs and replacements, having insurance can be a prudent decision for many stair lift owners. Evaluating the benefits and potential drawbacks can help you decide if stairlift insurance is the right choice for you.

Stairlift insurance is not a mandatory requirement in the UK, but it can provide significant peace of mind and financial protection. Given the high costs associated with repairs and replacements, having insurance can be a prudent decision for many stair lift owners. Evaluating the benefits and potential drawbacks can help you decide if stairlift insurance is the right choice for you.

When deciding whether stairlift insurance is necessary for you, consider the following factors:

- Stairlift age and condition: Newer stairlifts with robust warranties might not require additional insurance. However, if your stairlift is older or more prone to issues, insurance could be more beneficial.

- Financial situation: Evaluate your ability to cover unexpected repair costs out of pocket versus the cost of regular insurance premiums.

- Usage frequency: If you rely on your stairlift daily, insurance can provide crucial support and quick repairs, minimising downtime and inconvenience.

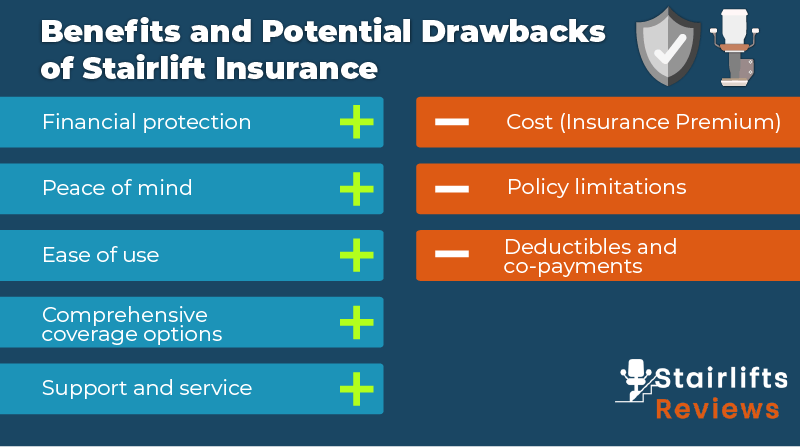

Benefits of having stairlift insurance

Understanding the advantages of lift insurance can highlight its importance and help you make an informed decision.

- Financial protection: Insurance can cover the cost of repairs or replacements, which can be expensive, especially for complex or high-value stairlifts. This protection helps avoid unexpected expenses that might strain your budget.

- Peace of mind: Knowing that you are covered in case of malfunction, damage, or theft provides peace of mind. This can be especially important for users who rely heavily on their stairlift for daily mobility.

- Comprehensive coverage options: Many policies offer comprehensive coverage that includes a wide range of potential issues, such as mechanical failures, accidental damage, and even regular maintenance checks.

- Support and service: Insurance often includes access to professional repair services, ensuring that any issues are resolved quickly and effectively by qualified technicians.

Disadvantages of stairlift insurance

While stairlift insurance offers several benefits, it’s also important to consider potential drawbacks.

- Cost: Depending on the level of coverage and the value of your stairlift, insurance premiums can be high, and can go as high as £500 a year. This ongoing cost might not be justifiable for everyone, especially if your stairlift is relatively new or has a good warranty.

- Policy limitations: Not all damages may be covered such as not covering pre-existing conditions, battery replacements or certain mechanical failures. Some policies might have exclusions or limitations that reduce their overall effectiveness. It’s crucial to read the fine print and understand what is and isn’t covered.

- Deductibles and co-payments: Some insurance policies require you to pay a deductible or co-payment for repairs or replacements, which can still result in out-of-pocket expenses.

How much does stairlift insurance cost?

Prices for lift insurance can vary widely based on the extent of coverage. Basic policies may start at around £40 annually, while comprehensive plans can exceed £500. Understanding the cost factors can help you choose the right policy for your needs.

Stairlift insurance costs in the UK generally fall within approximately £40 to £150 per year for basic policies and £150 to over £500 per year for comprehensive policies.

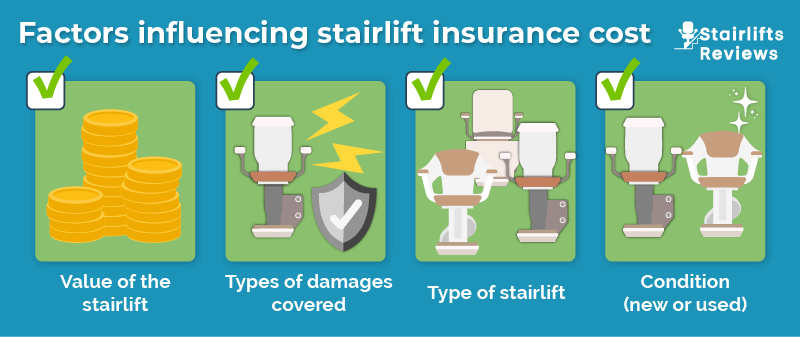

Several key factors determine the cost of stairlift insurance:

- Value of the stairlift: As the cost of the stairlifts increases, you would incur higher insurance premiums due to the increased cost of repairs or replacements.

- Types of damages covered: Policies that cover a broader range of damages, including accidental damage, mechanical failures, and theft, will generally be more expensive.

- Type of stairlift: Curved stairlifts and perched stairlifts often have higher premiums compared to straight stairlifts due to their complex design and higher repair costs.

- Condition (new or used): Used stairlifts are more likely to encounter issues, leading to higher insurance costs. New stairlifts might be cheaper to insure, especially if they come with manufacturer warranties.

Stairlift insurance costs by company

Here’s a breakdown of the annual insurance costs from some of the major providers in the UK:

| Stairlift Insurance Cost of Different Companies in the UK | ||

|---|---|---|

| Company | Basic Policy | Comprehensive Policy |

| Age UK | £50 to £120 | £200 to £450 |

| Acorn | £60 to £130 | £250 to £500 |

| Stannah | £55 to £140 | £225 to £475 |

| Handicare | £45 to £125 | £200 to £460 |

| Age Co Mobility | £50 to £135 | £220 to £480 |

Understanding the costs and benefits of stairlift insurance can help you make an informed decision. The price you pay will depend on the value and type of your stairlift, the extent of the coverage, and whether the stairlift is new or used.

Looking for stairlift quotes? Instead of spending hours researching and contacting multiple companies yourself, try our simpler method. Just fill out our quick 30-second form, and you’ll get up to 4 free quotes from local stairlift providers and installation experts. This service is entirely free and comes with no obligations. Click the button below to begin!

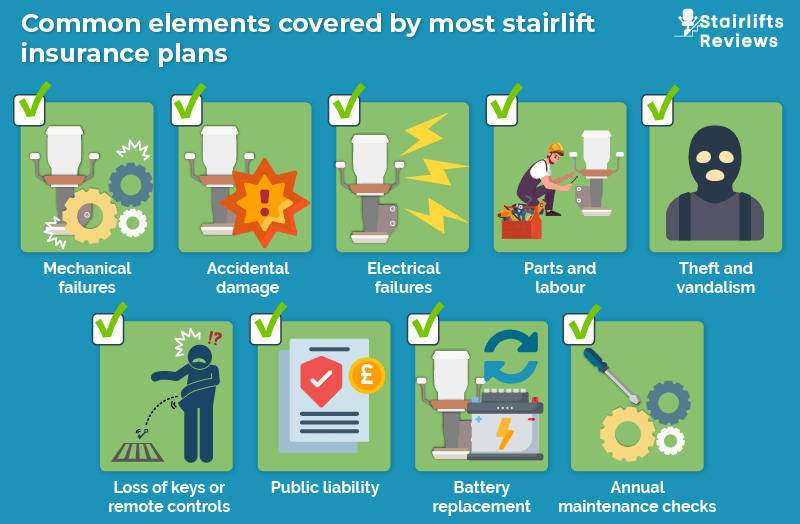

What does a stairlift insurance cover?

Stairlift insurance provides a safety net against various unexpected issues that can arise with your stairlift. The coverage can vary widely depending on the policy and provider, but here are the common elements that most stairlift insurance plans typically cover:

Stairlift insurance provides a safety net against various unexpected issues that can arise with your stairlift. The coverage can vary widely depending on the policy and provider, but here are the common elements that most stairlift insurance plans typically cover:

- Mechanical failures: Coverage for any mechanical breakdowns or malfunctions that occur, ensuring your stairlift can be repaired or replaced as needed.

- Accidental damage: Protection against accidental damages, such as bumps or knocks that may impair the stairlift’s function.

- Electrical failures: Insurance can cover electrical issues, such as wiring problems or motor failures, that prevent the stairlift from operating properly.

- Parts and labour: Includes the cost of replacement parts and the labour required to fix any issues.

- Theft and vandalism: While complete theft of a stairlift is uncommon due to their size and installation, partial theft of control units, batteries, and motors can occur. Vandalism can take forms of scratches, cutting wires or tampering with rails or seat mechanisms.

- Loss of keys or remote controls: Some policies cover the replacement of lost or damaged keys or remote controls used to operate the stairlift.

- Public liability: Provides coverage in case someone is injured while using the stairlift, protecting you from potential legal claims.

- Battery replacement: While batteries typically last between 3-5 years, some insurance policies cover the cost of replacing batteries when they become too old to function effectively.

- Annual maintenance checks: Many comprehensive policies include regular maintenance checks to ensure your stairlift remains in optimal condition.

Understanding the coverage options available with stairlift insurance helps you protect your investment and ensures reliable operation. From mechanical and electrical failures to accidental damage and battery replacement, comprehensive policies offer extensive protection. Always check the specific terms and conditions of your policy to know exactly what is covered.

What are the alternatives to stairlift insurance?

While stairlift insurance offers comprehensive protection, it is not the only option available to ensure your stairlift remains functional and cost-effective over time. Alternatives such as warranties and savings plans can also provide financial security and peace of mind.

While stairlift insurance offers comprehensive protection, it is not the only option available to ensure your stairlift remains functional and cost-effective over time. Alternatives such as warranties and savings plans can also provide financial security and peace of mind.

Warranty and extended warranties

Stairlift warranties and stairlift insurance are distinct in their coverage and purpose. While insurance covers a broad range of issues, warranties primarily focus on manufacturer defects and certain types of repairs or replacements.

- Standard warranty: Most stairlifts come with a standard warranty, typically covering 2 years, including second-hand models (confirming this fact is essential). Reconditioned stairlifts often come with a limited warranty, usually for 1 year, which may include one free service during that period. This warranty generally covers repairs or replacements due to manufacturer defects, ensuring that any issues related to the initial quality and manufacturing of the stairlift are addressed without additional costs.

- Extended warranties: Beyond the standard warranty, you can opt for an extended warranty, which prolongs the coverage period and sometimes expands the scope of covered issues.This prolongs the coverage period beyond the initial warranty, often up to 4 or 5 years.

- Expanded Scope: May include additional services like annual servicing, priority repair services, and comprehensive parts and labour coverage. Costs around £275-£550 per year.

Savings plan

Setting aside money each month into a savings plan can be a practical alternative to stairlift insurance. This approach allows you to build a fund specifically for stairlift maintenance and unexpected repairs.

- Monthly savings: By regularly saving a certain amount, you create a financial buffer that can cover the costs of repairs, maintenance, and even replacement if necessary. This proactive approach can provide peace of mind and financial flexibility.

- Control over funds: A savings plan gives you direct control over your money, allowing you to use it as needed without the constraints or exclusions that may come with insurance policies.

Home insurance add-ons

Stairlifts are essential mobility aids that can significantly improve the quality of life for individuals with limited mobility. While stairlift insurance is a specific product designed to cover a broad range of issues, some home insurance policies can also be extended to include stairlifts as part of the building’s fixtures and fittings.

- Building insurance: This covers the structure of your home, including fixtures and fittings. Stairlifts, being permanently installed, typically fall under this category.

- Contents insurance: This covers personal belongings within the home. While this generally does not include stairlifts, it may cover other mobility aids like wheelchairs or scooters.

It’s crucial to inform your insurance provider about the installation of a stairlift to ensure that your coverage is up-to-date. Provide specifics about the stairlift, including type, installation method, and safety features.

When considering alternatives to stairlift insurance, it’s essential to evaluate your specific needs and circumstances. Check the details of your stairlift’s standard warranty and consider if an extended warranty might be beneficial. Understand what is and isn’t covered to avoid unexpected expenses. If you choose a savings plan, ensure you can consistently set aside the required amount each month. This approach requires discipline but can be highly effective if managed correctly.

Alternatives offer viable options for maintaining and protecting your stairlift. Each option has its benefits and considerations, so evaluating them against your specific needs and financial situation is crucial.

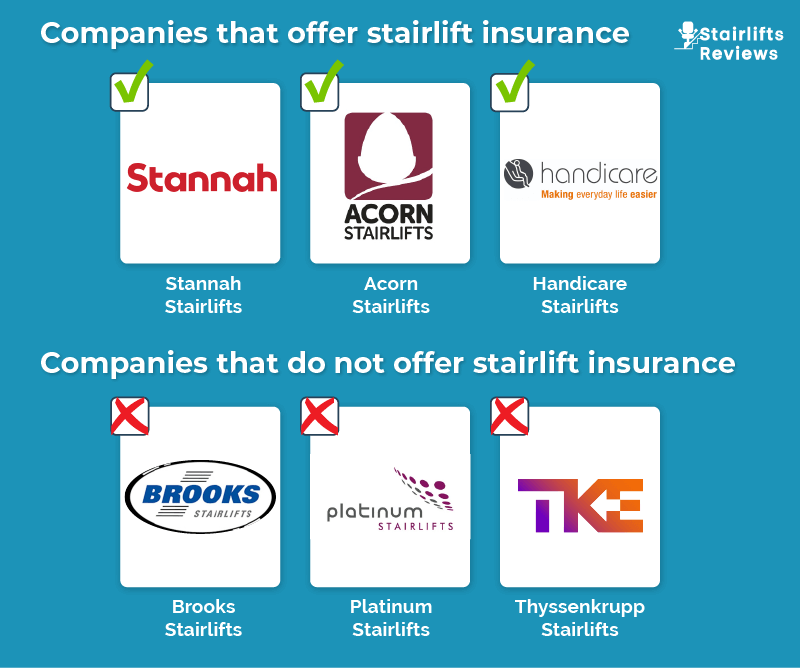

Which stairlift companies offer insurance?

When investing in a stairlift, it’s crucial to understand whether the company you choose provides insurance options or if you need to look elsewhere for coverage.

When investing in a stairlift, it’s crucial to understand whether the company you choose provides insurance options or if you need to look elsewhere for coverage.

Not all stairlift manufacturers and providers offer insurance directly, so it’s essential to know which companies provide this service and which require you to seek insurance from third parties.

Companies that offer stairlift insurance

Some leading stairlift companies in the UK offer insurance directly as part of their service package, providing convenience and comprehensive coverage tailored to their products.

- Stannah: Stannah offers a range of insurance plans to their customers. These plans cover various issues, including mechanical failures and accidental damage, providing peace of mind and financial protection directly through the manufacturer. Reconditioned stairlifts come with a one-year product warranty, including one free service during that year. Extended warranties are available for additional coverage.

- Acorn stairlifts: Acorn offers their own stairlift insurance policies, covering repairs, parts, and even regular maintenance checks. This ensures that customers can get comprehensive coverage specifically designed for Acorn stairlifts. Acorn offers a standard 12-month warranty with an option to extend for up to four additional years. The extended warranty includes annual servicing, priority attention, and covers all repair costs.

- Handicare: Handicare provides insurance options that include extensive coverage for their stairlifts. This often includes parts, labour, and annual service checks, ensuring the longevity and reliability of their products.

- Blue Badge Mobility Insurance: Blue Badge Mobility Insurance offers insurance specifically for mobility equipment, including stairlifts. Their policies often cover a range of risks, such as theft, damage, and mechanical breakdowns. Blue Badge Mobility insurance costs typically within the same range of £50 – £150 per year for stairlifts.

Companies that do not offer direct insurance

Some stairlift companies do not provide insurance directly and require customers to obtain coverage from third-party providers. This approach allows for more flexibility in choosing a plan that suits individual needs but can require additional research and effort.

- Brooks stairlifts: While Brooks offers robust warranties and service plans, they do not directly offer insurance. Customers typically need to find insurance coverage through third-party providers.

- Platinum stairlifts: Platinum Stairlifts focuses on product quality and customer service but does not offer insurance directly. Customers are advised to seek insurance through independent insurance companies specialising in mobility equipment.

- Thyssenkrupp: Thyssenkrupp stairlifts come with comprehensive warranties and maintenance packages, but they do not provide direct insurance options. Third-party insurance is necessary for additional coverage.

When considering stairlift insurance, it’s essential to evaluate the options provided by the manufacturer and compare them with third-party providers. Look for policies that offer comprehensive coverage at a reasonable cost, ensuring that all potential issues are addressed.

Understanding which stairlift companies offer insurance directly can simplify the process of obtaining comprehensive coverage for your stairlift. Whether through the manufacturer or third-party providers, securing insurance ensures financial protection and peace of mind.

Is stairlift insurance worth it?

Stairlift insurance can be a valuable investment for many individuals, offering significant financial protection and peace of mind. It helps cover the costs of repairs, maintenance, and potential replacements, which can otherwise be quite expensive.

If you rely heavily on your stairlift, have a high-value or custom model, or want to avoid unexpected out-of-pocket expenses, insurance is often worth considering. Overall, stairlift insurance can be a wise investment, providing essential coverage and reducing financial risk.

Looking for stairlift quotes? Instead of spending hours researching and contacting multiple companies yourself, try our simpler method. Just fill out our quick 30-second form, and you’ll get up to 4 free quotes from local stairlift providers and installation experts. This service is entirely free and comes with no obligations. Click the button below to begin!

FAQ

Can you get stairlift insurance?

Yes, stairlift insurance is available in the UK. Several providers offer insurance policies that cover repairs, maintenance, and potential replacements for stairlifts. Insurance can provide financial protection against unexpected costs and ensure that your stairlift remains operational.

How much does it cost to service a stairlift?

The cost to service a stairlift in the UK typically ranges from £90 to £150 per visit. This includes routine maintenance, such as checking and lubricating the track, inspecting the components, and ensuring the stairlift operates safely and efficiently. Costs for insurance on a stairlift can vary depending on the service provider and the complexity of the stairlift.

What is the warranty on stair lifts?

In the UK, most stairlifts come with a standard warranty of 2 years, which often covers manufacturer defects and parts. Some providers also offer extended warranties that can be purchased to extend coverage beyond the standard period. It’s important to check the specific warranty details with the manufacturer or supplier.

How long should a stairlift last?

A stairlift should typically last between 10 to 15 years with proper maintenance. Factors such as usage frequency, maintenance, and the quality of the stairlift can affect its lifespan. Regular servicing and timely repairs can help extend the life of your stairlift.

Is stairlift insurance worth it?

Stairlift insurance can be worth it, especially if you want to protect yourself from potentially high repair or replacement costs. It provides financial security and peace of mind by covering various issues that may arise with your stairlift. Evaluating the cost of insurance against the potential expenses of repairs can help determine if it is a valuable investment for you.